Most companies develop the sales budget in units and sales dollars because the remaining budgets will use both sales units and sales dollars. Assistant Manager/Controller Terry Dunn asked the new bookkeeper to help prepare the hotel’s master budget. The master budget is prepared once a year and is submitted to company headquarters for approval. Once approved, the master budget is used to evaluate the hotel’s performance.

Finely crushed quartz crystal is the only direct material used to produce the Wonderball. The crushed crystal is poured into a specialized machine with a small amount of proprietary chemical additives. The chemical additives are accounted for as indirect materials or manufacturing overhead. The crushed crystal mixture is pressurized, causing the particles to form a bond. The budget is used to control operations during the time period covered by the budget. The budget projects sales and revenue targets, production targets, and spending limitations for budgeted expenditures.

Connect With a Financial Advisor

An organization’s master budget consists of a set of interrelated but independent budgets that articulate the organization’s sales, production, profit, and financial position for a specified time period. A master budget is a tool used by management to effectively plan, control, and evaluate business operations. A business has expenditures that can be classified in a number of ways. One way to classify expenditures is by whether they are fixed or variable. When a business develops its operating budget, it must classify its expenditures as either fixed or variable. This is important because how an expense is classified affects a firm’s net income.

Selling expenses include both indirect and direct business costs. In many instances, SG&A expenses and operating expenses are one and the same. Both encompass the expenses necessary to operate a business independent of the https://accounting-services.net/mean-median-mode-and-range/ costs to manufacture goods. When these expenses are deducted from the gross margin, the result is operating profit. It’s important to note that not all expenses have been recorded when calculating operating expenses.

Forecasting Fixed and Variable Expenses

SG&A includes almost every business expense that isn’t included in the cost of goods sold (COGS). COGS includes the expenses necessary to manufacture a product including the labor, materials, and overhead expenses. SG&A costs are the residual expenses necessary to run the organization and incur costs less specifically tied to the cost of making the product. They are incurred in the day-to-day operations of a business and may not be directly tied to any specific function or department within the company. They are usually fixed costs that are incurred disregarding the amount of sales or production incurred during a certain period. After the production budget is prepared the direct labor budget is prepared.

How do you create an administration budget?

Administrative budgets are financial plans that include all expected selling, general and administrative expenses for a period. Expenses in an administrative budget include any non-production expenses, such as marketing, rent, insurance, and payroll for non-manufacturing departments.

SG&A plays a key role in a company’s profitability and the calculation of its break-even point. SG&A is also one of the first places managers look to when reducing redundancies after mergers or acquisitions. That makes it an easy target for a management team looking to quickly boost profits.

What is the difference between selling and operating expenses?

For example, if the firm’s salespeople work on commission, which is a variable cost because it changes month to month, and they are switched to a fixed salary, net income is changed. The amount of fixed and variable sales expenses have changed in proportion. The selling and administrative How To Prepare A Selling And Administrative Expense Budget expense budget is comprised of the budgets of all non-manufacturing departments, such as the sales, marketing, accounting, engineering, and facilities departments. In aggregate, this budget can rival the size of the production budget, and so is worthy of considerable attention.

- Since the ending inventory from one quarter becomes the beginning inventory in the next quarter, the company will start each quarter with 20% of the current quarter’s budgeted sales on hand.

- Most sales commissions are treated as selling expenses and should be reported on the income statement as part of Operating Expenses.

- To illustrate this step, assume that Leed’s management forecasts sales for the year at 100,000 units (each pair of shoes is one unit).

- The information in this budget is not directly derived from any other budgets.

- A business has many expenses that are not directly related to making or selling a product.

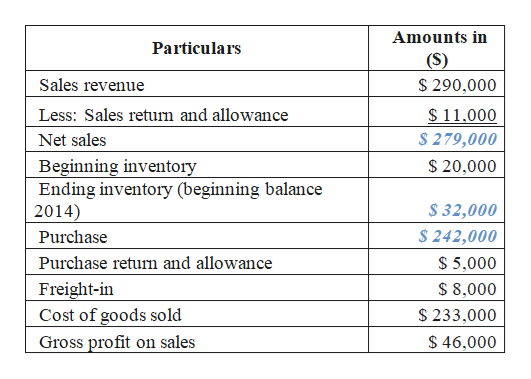

As demonstrated in Exhibit 6-1, the budgets are interrelated with some budgets feeding into other budgets. The sales budget is the first budget completed in the master budget. The estimated sales number drives many organizational decisions such as how many units to produce, how many people to employ, and what kind of facilities are necessary to support that level of sales activity. The budget is created prior to the time period covered by the budget. The completed budget is then used by management to help plan operations including activities like scheduling production, purchasing materials, and making capital investments. After managers forecast cost of goods sold, they prepare a separate budget for all selling and administrative expenses.

Budgeting Basics and Beyond by Jae K. Shim, Joel G. Siegel

Commissions based on units sold are included in this budget because those expenses are correlated not to the actual manufacture of the products, but to the eventual sale of the products. Overtime paid to employees making the products would be an expense directly related to the manufacture of the product. The direct materials purchases budget estimates the amount of raw materials purchases needed to produce the units scheduled for production plus the desired level of raw materials ending inventory. The production budget for Wonderball, Inc. is provided in Exhibit 6-4 below.

Overtime paid to manufacturing employees and cash on hand assets are not included in selling and administrative expenses. All companies must create documents that show the financial health and viability of the organization. After all the other budgets are prepared, budgeted financial statements can be prepared. Standard financial statements include the income statement, balance sheet, and statement of cash flows.

Cash on hand (such as a cash float from which employees can take money for incidental costs) is never included in the selling and administrative expenses budget. The operating budget is one of two budgets that make up the master budget, which is a financial planning document used by the firm as its overall plan for the next fiscal year. Forecasted expenses for the selling, general, and administrative budget are a vital part of the master plan for the firm and its operating budget. SG&A is both critical to the success of a business and vulnerable to cost-cutting. Cutting the cost of goods sold (COGS) can be tough to do without damaging the quality of the product.

What is an example of an administrative expense budget?

Administrative expenses are costs that relate to regular business operations. Administrative expenses can be fixed or semi-variable. Common examples include rent, utilities, equipment, supplies, insurance policies, salaries, benefits and legal counsel.

Next, take total direct labor hours times the direct labor rate per hour to get total direct labor costs. The direct labor costs per unit is calculated at the bottom of the direct labor budget. It is common to use several different direct materials to produce a final product in a manufacturing environment. A direct materials budget is prepared for each direct material used.